Solutions

Choose your firm type:

Select your firm type below to learn how New Range solves your specific compliance challenges across trade reporting, best execution, surveillance, corporate actions, and data reconciliation.

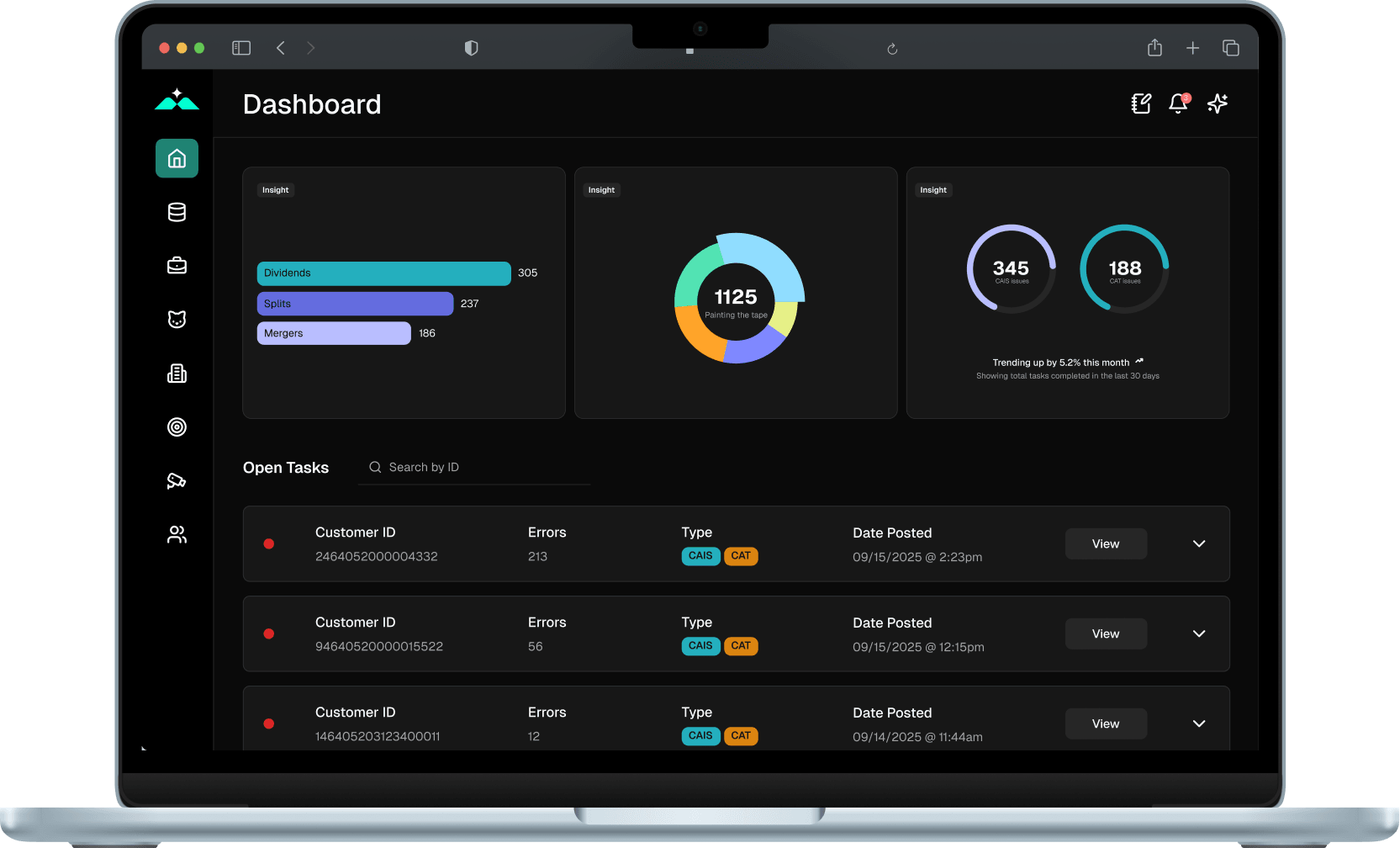

One Platform, Powerful Solutions

While each industry faces unique challenges, all benefit from New Range's core capabilities across five integrated modules:

Trade Reporting (CAT/CAIS): Automated submission and reconciliation

Best Execution: Comprehensive analysis and documentation

Trade Surveillance: Real-time monitoring and investigation

Corporate Actions: Complete event tracking and processing

Data Reconciliation: Cross-system validation

We tailor features, workflows, and interfaces to match your specific needs. We provide a comprehensive compliance platform your firm requires across all critical regulatory domains.

Ready to Transform Your Firm?

Schedule a demo to see how New Range solves your specific compliance challenges across trade reporting, best execution, surveillance, corporate actions, and data reconciliation. We'll show you the platform configured for your industry, answer your questions, and discuss how we can help your firm stay ahead of all regulatory requirements.

Schedule a demo